都不便宜了,新加坡本地股市最新的海峡指数成分股平均PE为15

不忘初心

都不便宜了,新加坡本地股市最新的海峡指数成分股平均PE为15

最新的诺贝尔经济学奖得主已经出炉,他就是著名行为金融学奠基者、芝加哥大学教授—理查德·塞勒(Richard Thaler). 网上读了关于他的一些得奖新闻和背景报道,让我感兴趣的是原来这位教授除了在象牙塔里研究成果丰硕,在资本市场也是搞得风生水起.

他和他的搭档Russel Fuller创建的 “Fuller & Thaler Asset Management”的投资成绩非常亮眼.这家公司在JP Morgan管理的一只基金 Undiscovered Managers Behavioral Value Fund(UBVLX)从09年到现在管理的资产市值翻了三倍,塞勒可以说真正的做到了将知识转化成生产力.

这个基金的详细资料和介绍可以在JP Morgan的网站找到: 点击

总结一下它的投资方向和理念如下:

其实这一套理论不光在美国适用,在新加坡本地市场也是屡试不爽的一个投资策略. 既然诺贝尔奖得主都给出了tips,我们怎么不牢记在心呢?

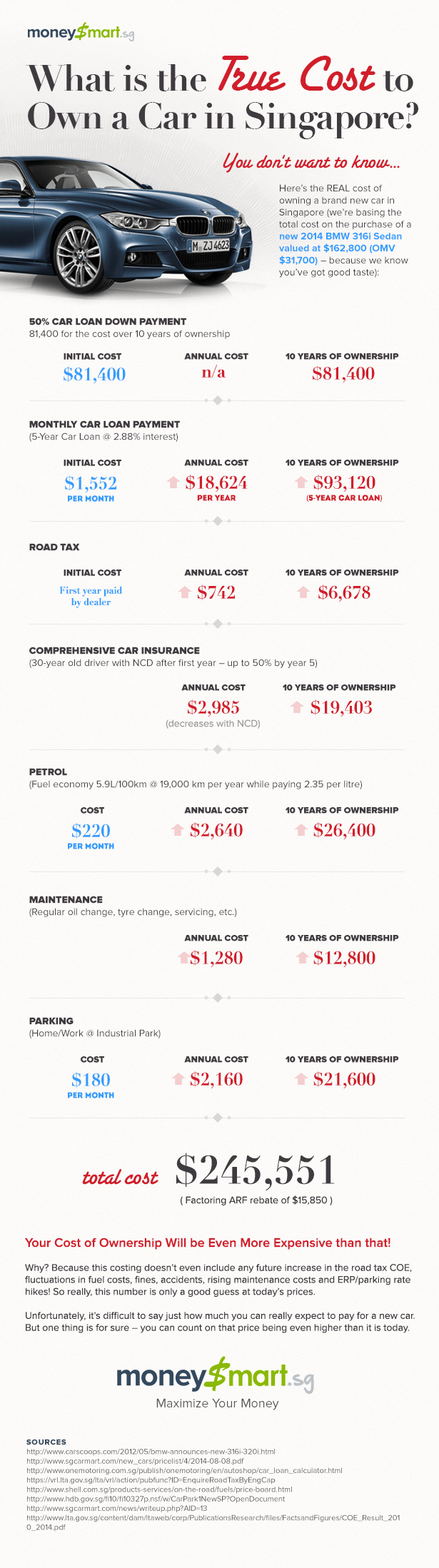

参考 : 美图一张

偶然在论坛发现的一张有趣的图

看了之后你还有买车的冲动吗?我还是去多薅一点GRAB和UBER的羊毛吧.

From fool.sg :

As investors, we may want to try and search for good businesses and that’s because doing so can often help lead us to good investments.

Yet, how can we quantify a good business? Is there a metric that investors can use to tell the difference between a high quality and low-quality business? I believe there is, and it is a metric known as the return on invested capital or ROIC. Here’s the math needed:

To understand ROIC, let’s imagine there are two coffee shops, Ali and Baba. Both shops currently have annual sales of $1 million and profit of $200,000 each. Based on the revenue and profit figures, both coffee shops look equally good.

But, Ali is located in the city centre and needed a large capital investment of $5 million ($4.5 million to acquire the property and $500,000 for working capital) to start.

Baba, on the other hand, is situated on the outskirts of town and thus required only $1 million in capital investment ($800,000 to buy the shopfront and $200,000 for working capital).

Using the above formula, the ROIC for Ali is just 4 % whereas Baba’s is 20%. We can, therefore, conclude that Baba is a better-quality business since it requires less capital to generate the same amount of profit.

So, put simply, ROIC is used to understand whether a business is good, average or bad. An average business generally has a ROIC of between 12% and 15%. Thus, a rule of thumb is that anything above 15% is considered a good business and anything lower than 12% is of low quality.

Some case studies shown below:

有关新加坡政治、社会、文化的报道、分析与评论

不忘初心

不忘初心

This site is about my investment journey, my travel and stuff I find interesting

不忘初心

不忘初心

不忘初心

不忘初心

Evidence-based investing off the beaten path.

Undiscovered And Undervalued Stocks - How To Find Them

CONTRARIAN, DEEP VALUE INVESTING IDEAS

一切源于生活, 有梦想就会飞